Key Points

- This month, President Trump signed an executive order promoting deep-sea mining to help secure domestic access to essential minerals.

- The Metals Company aims to extract nickel, cobalt, manganese, and copper from the ocean floor.

- While the executive order is a boost, significant challenges still loom over the company’s prospects.

Beyond Tariffs: Trump Turns to the Ocean Floor

Instead of focusing solely on tariffs or urging the Federal Reserve to lower interest rates, President Donald Trump is now turning his economic focus toward the ocean — more specifically, its depths.

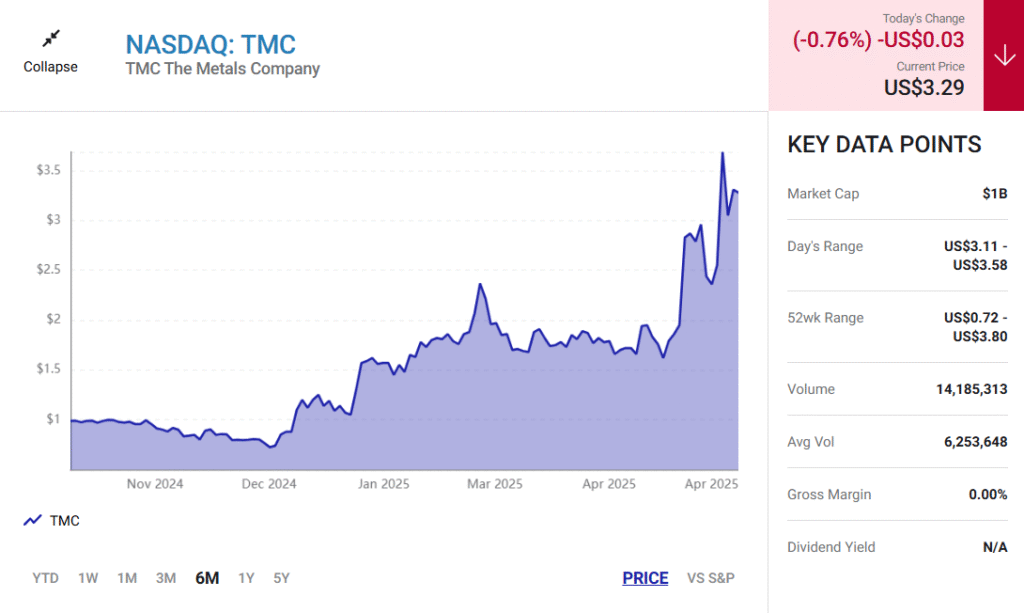

In a recent executive order, Trump instructed officials from the Departments of Interior and Commerce to accelerate the U.S.’s push to explore deep-sea mining for critical minerals. Similar to how shares of MP Materials jumped in mid-April following Trump’s commitment to stockpile rare earth elements, The Metals Company also saw its stock price rise following this announcement.

But does this development mean The Metals Company is a smart investment at this time?

Aiming for Mineral Independence Beneath the Waves

Critical metals such as nickel, cobalt, copper, and manganese are vital for modern technologies, including electric vehicle batteries and military hardware. The issue lies in the fact that the U.S. lacks sufficient domestic production of these minerals. In fact, the U.S. Geological Survey reported that in 2024, the country remained dependent on imports for 12 out of the 50 designated critical minerals. Additionally, China dominated the production of 29 of those minerals in 2023.

To address this shortfall, Trump’s executive order aims to, as stated by the White House, “develop domestic capabilities for exploration, characterization, collection, and processing of critical deep seabed minerals.”

In an attempt to reduce the risk of China limiting U.S. access to these resources, the executive order also notes it “strengthens partnerships with allies and industry to counter China’s influence in the seabed mineral resource space.”

Harvesting Nodules to Strengthen Supply Chains

While many mining operations focus on land-based extraction, very few target resources at the ocean’s bottom. The Metals Company stands out by using a system designed to collect polymetallic nodules from the seafloor. After being retrieved, these nodules are cleaned onboard and later processed onshore.

The company highlights several advantages that set it apart from potential rivals. In 2022, it carried out a successful pilot run, gathering about 4,500 metric tons of nodules and achieving a steady production rate of 86.4 metric tons per hour using its prototype nodule collector. This demonstration of an integrated system gives it a competitive edge.

Another strength is The Metals Company‘s exclusive exploration rights within the Clarion Clipperton Zone, an area rich in nodules located in international waters. The firm believes these zones contain enough material to support the production of batteries for approximately 280 million electric vehicles.

Challenging Depths Ahead for The Metals Company

Despite the executive order, The Metals Company still faces several substantial risks. Chief among them is the lack of global consensus on deep-sea mining. The company continues to await regulatory approval from the International Seabed Authority (ISA) — a body under the U.N. — to move forward with commercial operations, a delay that has persisted for years.

Additionally, Trump’s push for deep-sea mining has sparked criticism from China, which argues that the initiative is a violation of international law. This could escalate tensions and open up a new front in the U.S.-China trade conflict.

Even if the ISA gives the green light and regulatory hurdles are cleared, there remains uncertainty over whether the business model itself is viable. There is no assurance the company can operate profitably.

Should Investors Dive In Now?

Although Trump’s executive order may seem like a strong tailwind for The Metals Company, seasoned investors know that government announcements don’t automatically translate into sound investment opportunities. Key questions remain about whether the company will actually launch commercial operations and turn a profit.

As such, investing in The Metals Company is best suited for those who have a high tolerance for risk.

Why TMC May Not Be the Top Choice in the U.S. Mining Boom

Before jumping into TMC The Metals Company, here’s something important to keep in mind:

“It’s all being driven by a short-term tariff pause that could expire any day. And while TMC The Metals Company might look like a smart move, we think the real winner is a company 1/100th the size of NVIDIA.”

This lesser-known company provides key infrastructure for giants like Apple and OpenAI. A full analysis of this under-the-radar stock has been shared with all Stock Advisor members — and now might be the ideal moment to pay attention.